For the attention of:

AICB is pleased to inform you that the study texts for Certified Credit Executive (CCE), Business Credit Professional (BCP) and Retail Credit Professional (RCP) under the Professional Credit Certification (PCC) qualification were updated and uploaded onto AICB's Member Portal – Online Learning on 24 August 2020. Kindly note that these revisions will be examinable on updated PCC modules beginning 1 June 2021.

To ensure a smooth learning journey, AICB has developed a Summary Guide below, which is also available on the Member Portal.

1.0 What has changed in the current study text?

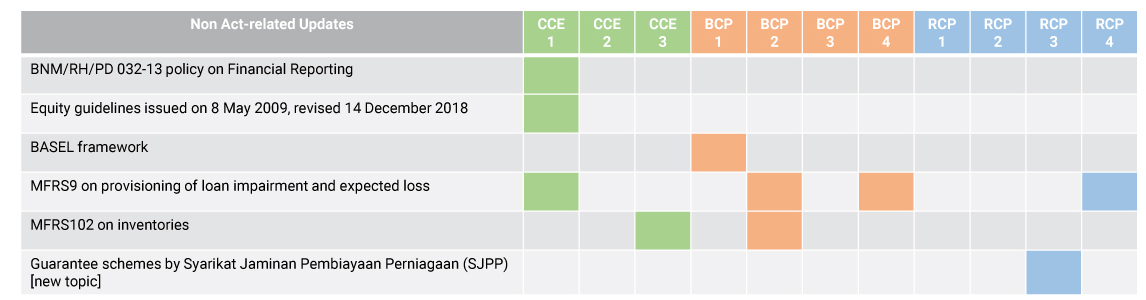

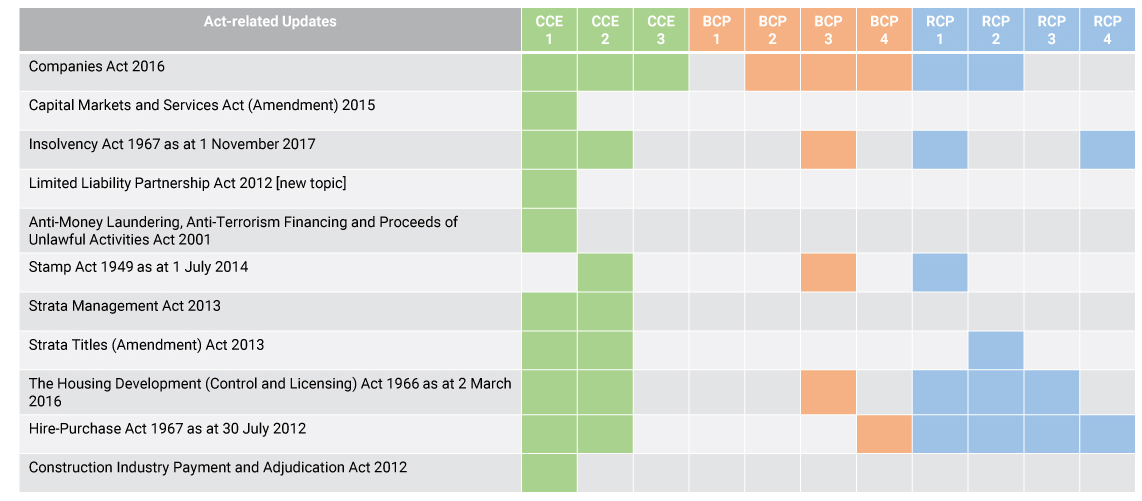

The table below shows the updates by module.

1.1 Non-Act related Updates

1.2 Act-related Updates

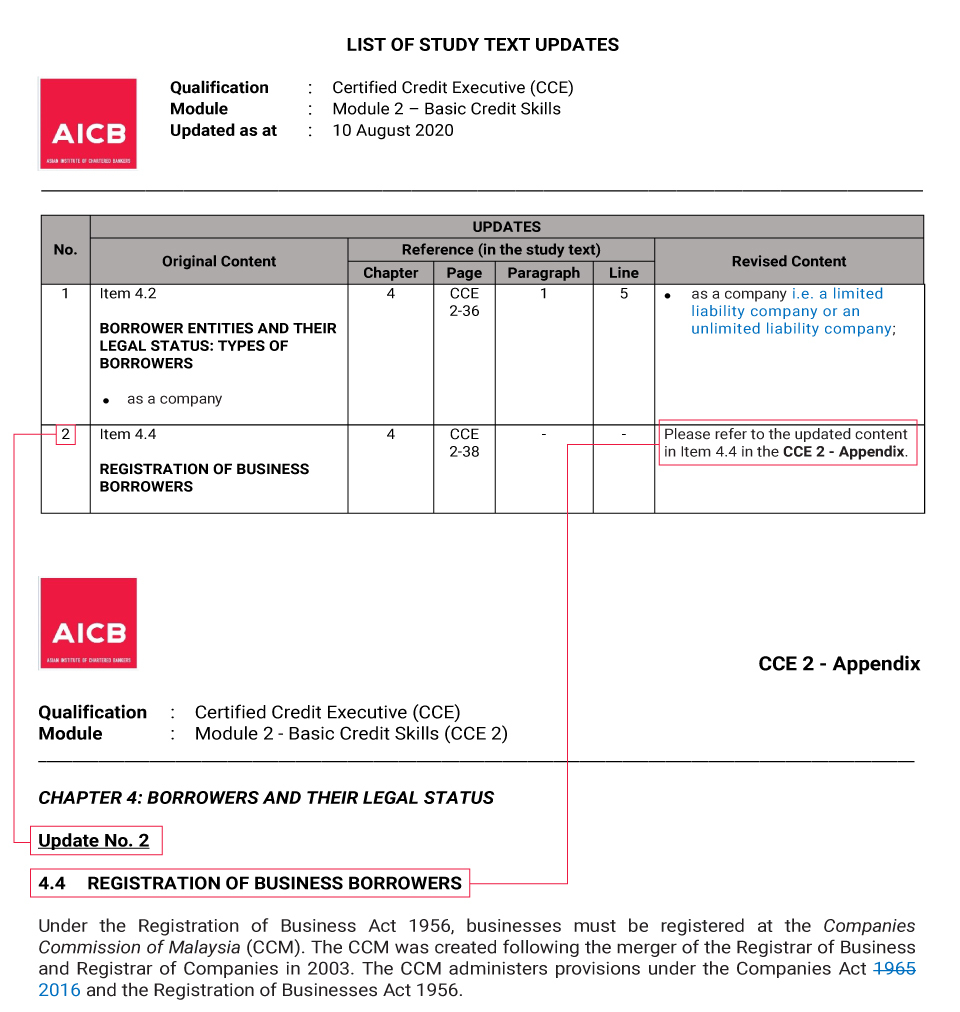

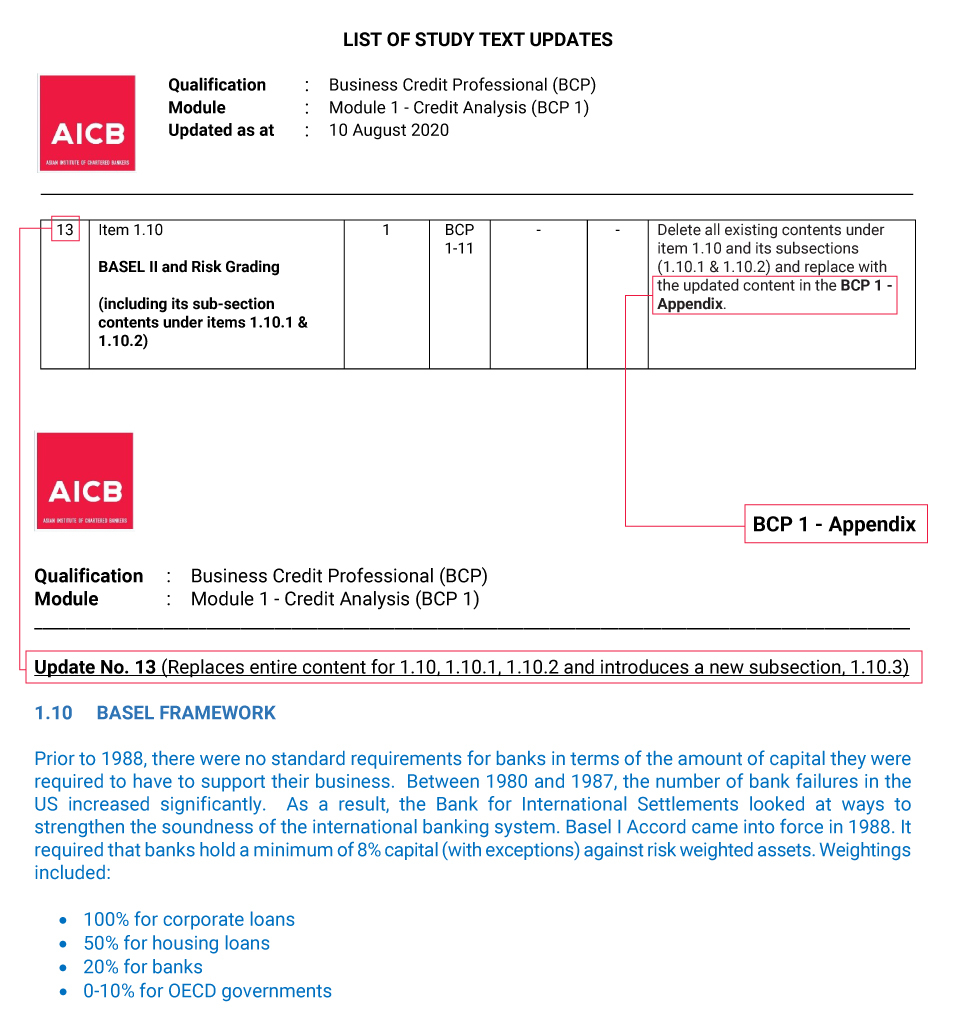

2.0 How do I read the updates?

3.0 How would the examination be impacted following the updates?

Please refer to theexamples below. Certain questions could have different answers following updates to the study texts.

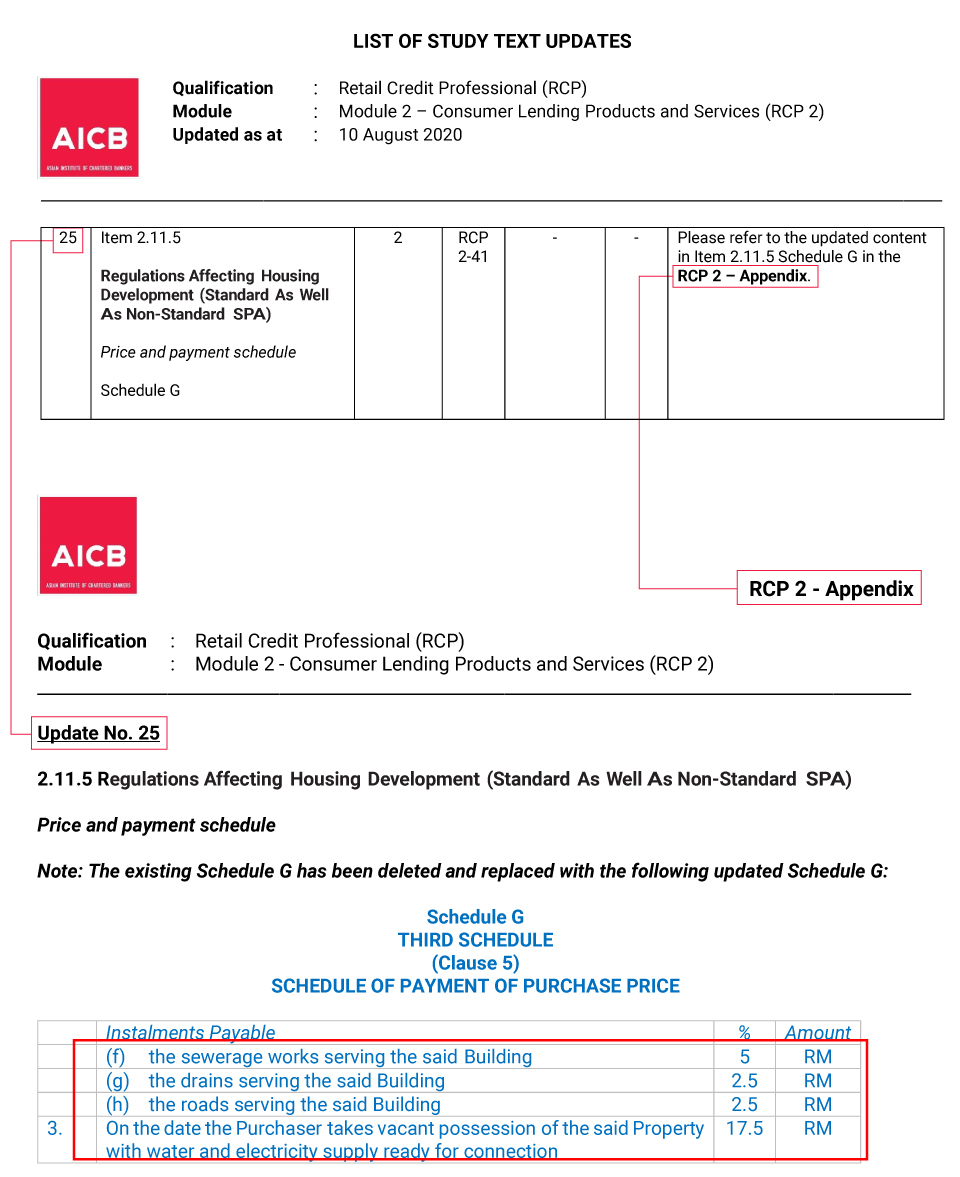

Example 1: RCP Module 2

| Previous Content | Revised Content |

|---|---|

A customer seeks financing from your bank to finance the purchase of 2 adjacent units of apartments in a newly launched mixed development in Shah Alam. The purchase price for each unit is RM450,000 with a built-up area of 750 sqft. Assuming the approved margin of financing is 90%, based on the Third Schedule of SPA: How much would have been paid to the developer at the stage just prior to vacant possession of the units? a. RM900,000 | Answer: d. RM675,000 Sect 2.11.5 (revised content – Update No. 26), Regulations Affecting Housing Development (Third Schedule H). From 80% to 75% [NB : 75% x total SPA price RM900,000 = RM675,000] |

Example 2: BCP Module 3

| Previous Content | Revised Content |

|---|---|

BNM requires Financial Institutions to maintain a minimum SRR Ratio of: a. 2% | Answer: a. 2% Sect 2.11.5 (revised content – Update No. 11), New Statutory Reserve Requirement (SRR) Ratio. In March 2020, BNM announced that the SRR ratio will, with immediate effect, be lowered by 100 basis points from 3% to 2% in an effort to shore up liquidity in the banking system due to current pressure on the Malaysian economic situation. |

Example 3: CCE Module 2

| Previous Content | Revised Content |

|---|---|

A private limited company has 20,000 shares. What will be the company’s share capital? a. Depends on the nominal value of the share (Answer) | Answer : b. Determined by the directors Sect 4.4.4 (revised content – Update No. 4). Introduction of the no par value shares (NPV) regime. Shares are issued at a price to be determined by the directors. |

We will get back to you shortly.

There's an error submitting your query. Please try again later.