INTRODUCTION TO FINANCIAL MARKETS ASSOCIATION OF MALAYSIA (FMAM) PROGRAMMES

ACI–Financial Markets Association of Malaysia (FMAM) was established in 1974 with the objective of providing an association for those who are actively engaged in the wholesale foreign exchange and money market in Malaysia. ACI-FMAM is also actively involved in education to develop and enhance the knowledge and skills of its members.

In its efforts to upgrade members’ knowledge and skills, ACI-FMAM has imposed qualifying examinations for its new members since 1995. Members must pass the four modules of the PKMC qualification before they are licensed to participate in the interbank foreign exchange and money market.

The other main objective of ACI-FMAM is to constantly review the techniques and practices in the forex and money markets in order to develop, improve and maintain high standards comparable to international practices and techniques.

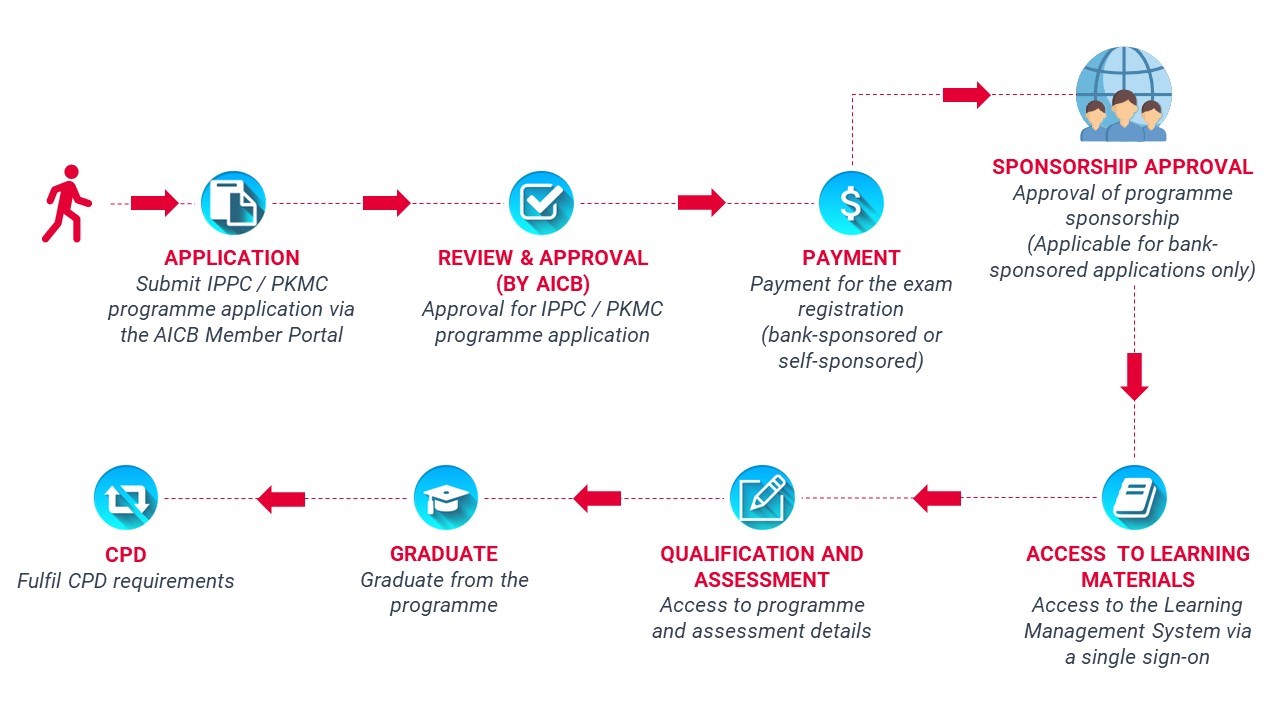

AICB offers the Investor Protection Professional Certification (IPPC) and Pasaran Kewangan Malaysia Certificate (PKMC) programmes in collaboration with ACI-FMAM.

1. Investor Protection Professional Certification (IPPC)

The IPPC is an exam-based qualification jointly awarded by AICB and the ACI-FMAM. As a certified IPPC professional, you will be professionally qualified to market and sell structured products and unlisted debt securities to meet the regulatory requirements under the Guidelines on Investor Protection jointly issued by Bank Negara Malaysia and Securities Commission Malaysia. The IPPC programme covers four study areas that focus on market structure; investor protection guidelines, law and regulations; Know-Your-Client best practices; and the various types of investment products available. The IPPC programme is only open to registered members of ACI-FMAM.

Note: Upon completion of the IPPC programme, members can proceed to take the Chartered Banker Level 2 programme.

2. Pasaran Kewangan Malaysia Certificate (PKMC)

The PKMC is a professional requirement established by ACI-FMAM for dealers and brokers employed in licensed financial institutions and money broking firms. The certification aims to ensure that the Malaysian financial markets possess competent and proficient practitioners who subscribe to the highest standards of professionalism and integrity to ensure that the industry grows in an orderly manner. Designed for Provisional members, Provisional Broker members and Affiliate members of ACI-FMAM, the certification is jointly awarded by ACI-FMAM and AICB.

Note: Upon completion of the PKMC programme, members can proceed to take the Transition Professionalism & Ethics (TRPET) before progressing to Chartered Banker Level 3 programme.

TARGET AUDIENCE

Investor Protection Professional Certification (IPPC)

Employees of registered persons (as defined in the Guidelines on Investor Protection, jointly issued by Bank Negara Malaysia and Securities Commission Malaysia) involved in the selling and marketing of structured products and unlisted debt securities.

Pasaran Kewangan Malaysia Certificate (PKMC)

- Dealers and brokers employed in licensed financial institutions and money broking firms.

- Provisional members, Provisional Broker members and Affiliate members of ACI-FMAM

ENTRY REQUIREMENTS AND ENROLMENT

For more details on the entry requirements and documentation required for enrolment, click here.

MEMBERSHIP AND PROFESSIONAL DESIGNATION

Upon successful completion of Pasaran Kewangan Malaysia Certificate (PKMC), a Provisional member will be upgraded to an Ordinary member or an International member of ACI-FMAM and admitted as an Associate member of AICB. Both ACI-FMAM and AICB memberships are mandatory for dealers employed in licensed financial institutions or money broking firms. With this dual membership, a member is entitled to carry the following professional designations, as applicable:

Certified Financial Markets Practitioner (CMP)

To carry this designation, candidates must complete the PKMC qualification, and be an Ordinary member of ACI-FMAM and an Associate member of AICB. Candidates must also be employed in a dealing room and be authorised dealers.

Certified Senior Financial Markets Practitioner (CSMP)

To carry this designation, candidates must complete the PKMC qualification; be an Ordinary member of ACI-FMAM and an Associate member of AICB; be employed in a dealing room; be an authorised dealer; possess a minimum of 10 years of dealing experience, and must not have left the industry for more than 2 years.