INTRODUCTION TO CHARTERED BANKER

As the flagship qualification of the Asian Institute of Chartered Bankers (AICB), the Chartered Banker is a globally recognised professional banking qualification as well as a prestigious professional designation. Jointly awarded by AICB and the Chartered Banker Institute in the United Kingdom, the only organisations able to confer the status of Chartered Banker in SEA and globally respectively, this qualification will help you achieve and maintain the highest standards of excellence and professionalism.

LEARNING OUTCOMES

The qualification aims to produce banking professionals who:

- demonstrate extensive knowledge of the banking sector and are able to manage complex issues and perform a wide range of banking functions.

- exercise sound judgment and make informed decisions in relevant work situations

- are ethical and professional, and able to develop strategies to improve organisational performance.

TARGET AUDIENCE

- Aspiring entrants and entry level executives in the banking industry.

- Banking professionals with several years of experience.

- Experienced professionals aspiring to hold leadership roles in the banking industry.

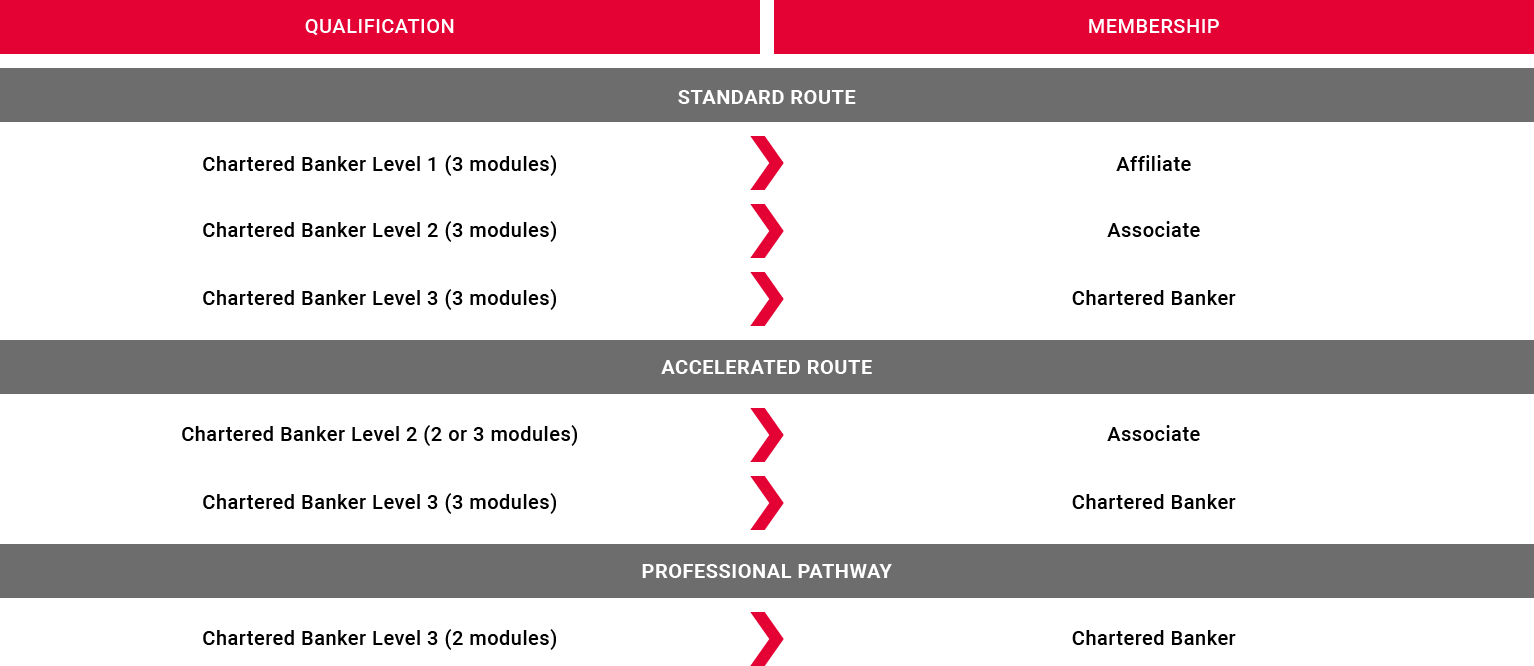

CERTIFICATION PATHWAYS

There are a few routes to becoming a Chartered Banker. For more details, click here.

ENROLMENT

Candidates are required to submit the prerequisite supporting documents for enrolment. For full details on documentation, click here.

MEMBERSHIP AND PROFESSIONAL DESIGNATION

Members who have completed Level 3 of the Chartered Banker programme will be conferred the ‘Chartered Banker’ status and are entitled to use the membership designation, ‘CB’. Click here to find out more.

MODULES

Click here to view the Chartered Banker modules.

ASSESSMENT

Click here for more information on the assessment format.

EXAM

Click here for more information on examinations.